Climate change induces substantial risks to society and businesses. Extreme events are frequent and intense, and not in alignment with natural variability.

From 2011-2020, the average global temperature over land and ocean was 1.09 and 0.88 °C, respectively, more than the values from 1850-1900. Between 1971-2018, oceans absorbed over 90% of additional heating, causing sea level rise. The global temperature increase at the end of the century will range from 1.5-5 °C. With retreating glaciers, rising sea levels and higher GHG concentrations, the frequency of unprecedented climate impacts has increased.

These impacts create climate-related risks including:

1

Physical Risks – According to IPCC, climate risk is a function of hazard, exposure and vulnerability. They emanate from extreme weather events resulting in damage to physical assets, economic loss, environmental damage and livelihood disruption. They can be branched further into:

- Acute Physical Risks – These arise from specific weather events with greater severity like hurricanes, cyclones and floods.

- Chronic Physical Risks – These result from gradual shifts from long-term climatic patterns like increased sea level or degradation in soil quality.

2

Transition Risks – Moving to a lower-carbon economy by implementing adaptive and mitigative strategies has its own risks, like regulations, newer technologies, customer behavior and the functioning of markets.

How do these impact businesses?

The potential cost of insuring assets against climate change impacts can be greater than 4% of their market value. Forecasts estimate the total costs of climate change to be 4-18% of global GDP if the world fails to be net zero by 2050. Organizations can be affected either directly or indirectly. Factors like geographical spread, projected climatic patterns and the dependency on global supply chains govern these impacts. For instance, if a company has its manufacturing base in an area prone to flooding, they are directly impacted by property damage. If it does not have other manufacturing facilities, its supply chain faces ripple effects.

Some of the impacted parameters include:

Production Yield – Supply chain dysfunctionalities owing to transportation delays result in lower yields, and thereby, lower revenue. The 2011 floods in Thailand affected electronic equipment manufacturers directly. Western Digital lost nearly 45% of its shipments.

Productivity of Workers – Extreme working conditions negatively impact worker well-being. The absenteeism adds to the impact costs. The 2013-2014 Australian heatwave led to nearly $6 billion in productivity losses.

Operating Costs – Depletion or unavailability of resources like water, rich soil, etc., is likely to cause a spike in operational spending.

Insurance Premiums – High-risk areas will experience reduced insurance options, and the insurance premiums will increase with the risks. Assets worth $1-4 trillion are likely to be stranded by 2030 within the oil and gas sector.

Capital Costs – Facility damage due to hazards. The property damage from Hurricane Ian was between $42-258 billion.

While these impacts attribute directly to the physical risks, their non-linear and cascading nature compels organizations to move beyond the direct consequences. For instance, drought can cause crop failure, which in turn results in food crisis and unemployment, and leads to reduced global trade.

How can businesses navigate the landscape of physical risk management?

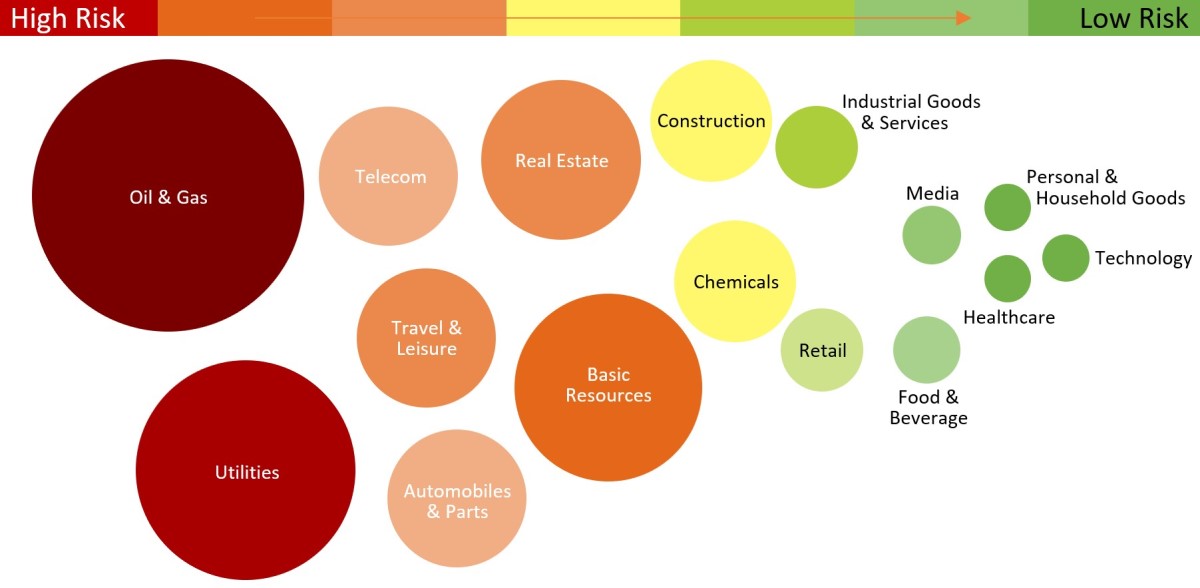

Climate action failure and extreme weather have been rated as top risks over the next 10 years on a global scale. According to estimates, the physical risks will be more dominant from 2030. When comparing companies’ capital intensity and exposure to physical risks, oil and gas, utilities, and basic resources emerged as the industries likely to be severely impacted.

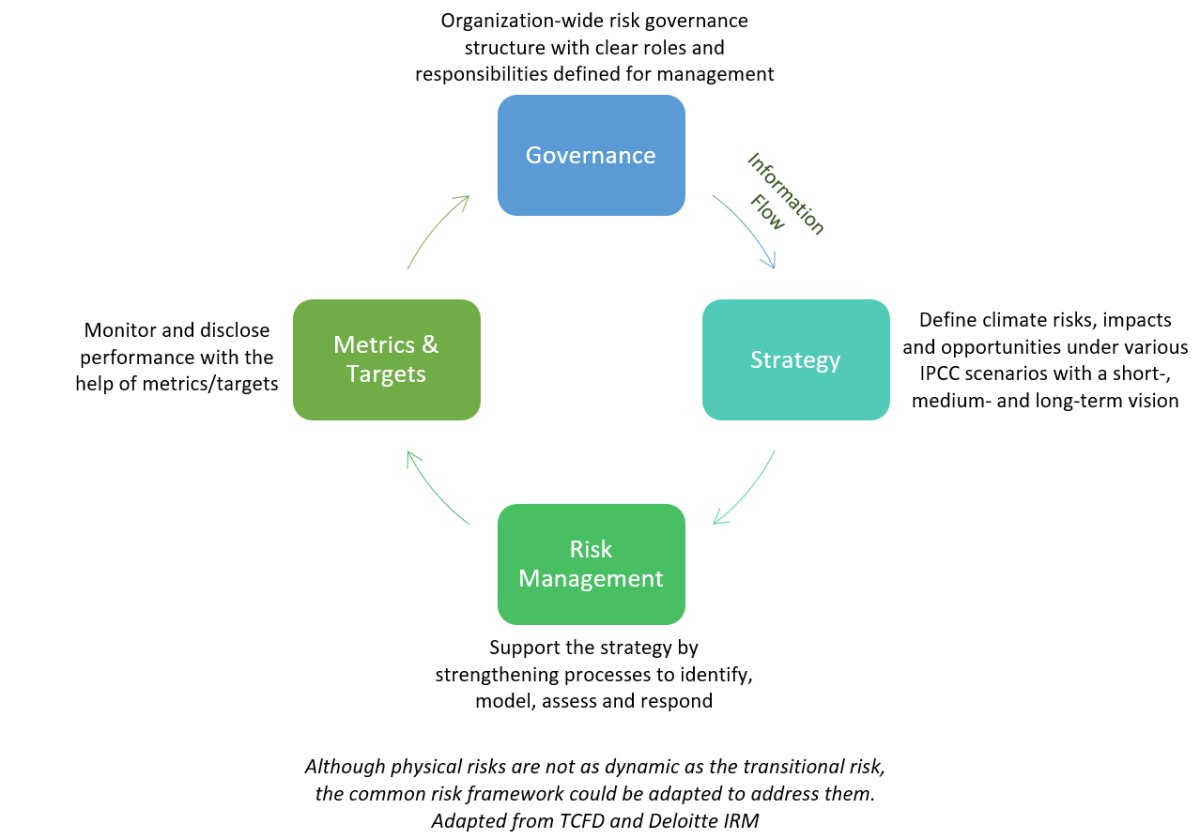

Organizations with ambitious growth targets are likely to prioritize risk management as one of the critical strategies to thrive. Integration of risk throughout the enterprise can be associated with higher growth percentages. For instance, nearly 34% of companies with a CAGR > 5% have highly integrated risk management strategies as opposed to just 21% of companies with CAGR < 5%. Nearly 40% of professionals ranked ESG (including climate) risks in their top risk categories of absolute importance for next 2 years. Determining the appetite for strategic and non-financial risks has proven to be extremely challenging for organizations.

A 360-degree approach to developing adaptive and mitigative pathways must incorporate climate science, business strategy and technology into the solution.

Linking Physical Climate Risks with Supply Chain

Environmental disruption causes 72% of climate change impact throughout the supply chain. The degree of specialization within supply chains is proportional to the severity of impact on downstream players, i.e., the specialized product comes with a heightened effect.

In a study of 100 OEMs across the US, China and Taiwan, data on climate variability and the corresponding business impact was collected over 35 years for comparison. It was found that only 11% of all sites were prepared for climate-related disruptions. Knock-on effects affect supply chains more significantly than physical asset damage.

We can easily mitigate the risks associated with a 1-in-100 event if we integrate them into the supply network planning. A well-prepared player would incur a 5% revenue loss, while an unprepared player might lose about 35% of revenues under the same circumstances.

Supply chain risk mitigation strategies include:

Supply Chain Mapping – Identification of all the sites throughout the supply chain that directly or indirectly drive its functionality. We must collect data related to climate and operations to understand the risks better.

Risk Detection Driven by Technology – Deploying AI in analyzing climate, operational and projected data to build a risk analytics model. The early detection of patterns will help organizations formulate adaptive and mitigative strategies.

Insurance – Insurance against revenue loss or disruption in the supply chain can help navigate the initial days of undersupply by offering a time margin to reshuffle the supplier base.

Inventory – Downstream players can prepare by having estimated buffer stock to plug the shortage. Holding higher inventory levels equips businesses to deal with the sudden shortage.

Sourcing Strategy – Having an alternate supply base across geographies diversifies the risk. Since the hazard-prone region would be confined, the organization can quickly turn to alternate suppliers to meet the demand.

Hazard Protected Plants – In places like Southeast Asia, securing plants can approximate to just 2% of the building costs. A nominal investment allows companies to face the immediate consequences with a greater ease.

Organizations can avoid revenue losses, retain customer confidence and safeguard supplier networks by integrating risk planning into supply chain management.